Labor Laws in the Czech Republic

- Annual Leave: 4 weeks

- Maternity Leave: 28 weeks

- Public Holidays: 14

- Workweek: 40 hours per week.

Get everything you need to hire talent in the Czech Republic. Download our comprehensive guide for hiring in this expanding market.

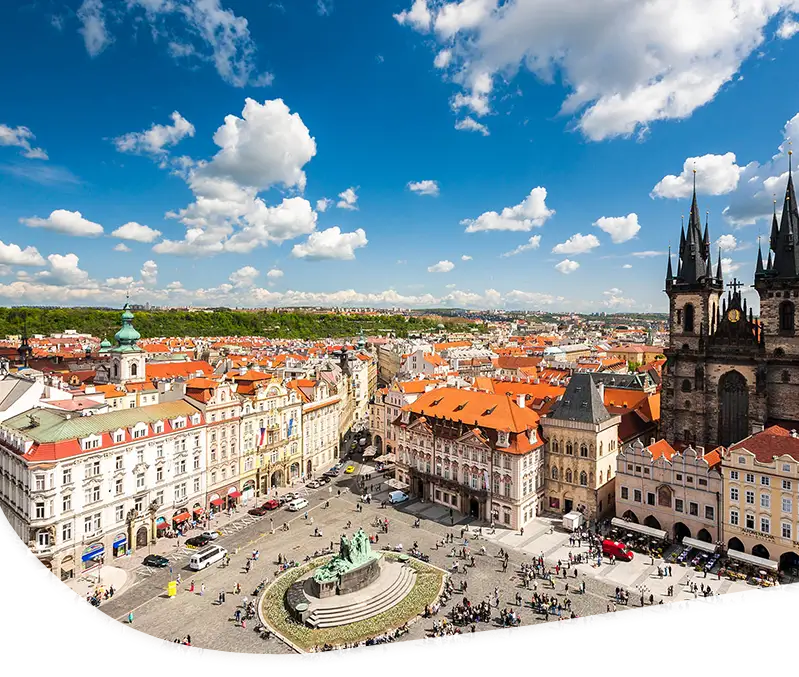

Capital:

Prague

Language:

Czech

Currency:

Czech Koruna

Please enter the following information:

Individual income taxes are progressive, ranging from 15% to 23% based on the worker’s earnings.

The standard sales tax is 21%.

Social security contributions for employers and employees are as follows:

The payments are made by the employer (for both the employee's part deducted from one's gross salary and the employer's parts paid on top of the gross salary).

The maximum annual cap for the assessment base for the calculation of contributions into the social security system is 48 times the average monthly wage per year (i.e. CZK 2,110,416 for 2024). This cap applies to both employees and entrepreneurs.

There is no cap for contribution to health insurance.

Types of Work Visas in the Czech Republic:

Employee Card:

EU Blue Card:

Intra-Company Employee Transfer Card:

Short-term visa – Type C:

Setting up a company in the Czech Republic can be expensive and complex. Global Expansion simplifies your entry into this market.

We handle hiring, HR, and payroll while ensuring compliance with local regulations, all without establishing a local entity.

Our Czech Republic Employer of Record (EOR) solution gives you the freedom to focus on your business growth.